Overview

The HitPay dashboard provides you with the ability to monitor and analyze your transactions and gain insights into your business’s performance. This guide takes you on an comprehensive journey through the Sales & Reports features on HitPay.Export Transactions

Exporting of transaction is only available on the Web dashboard

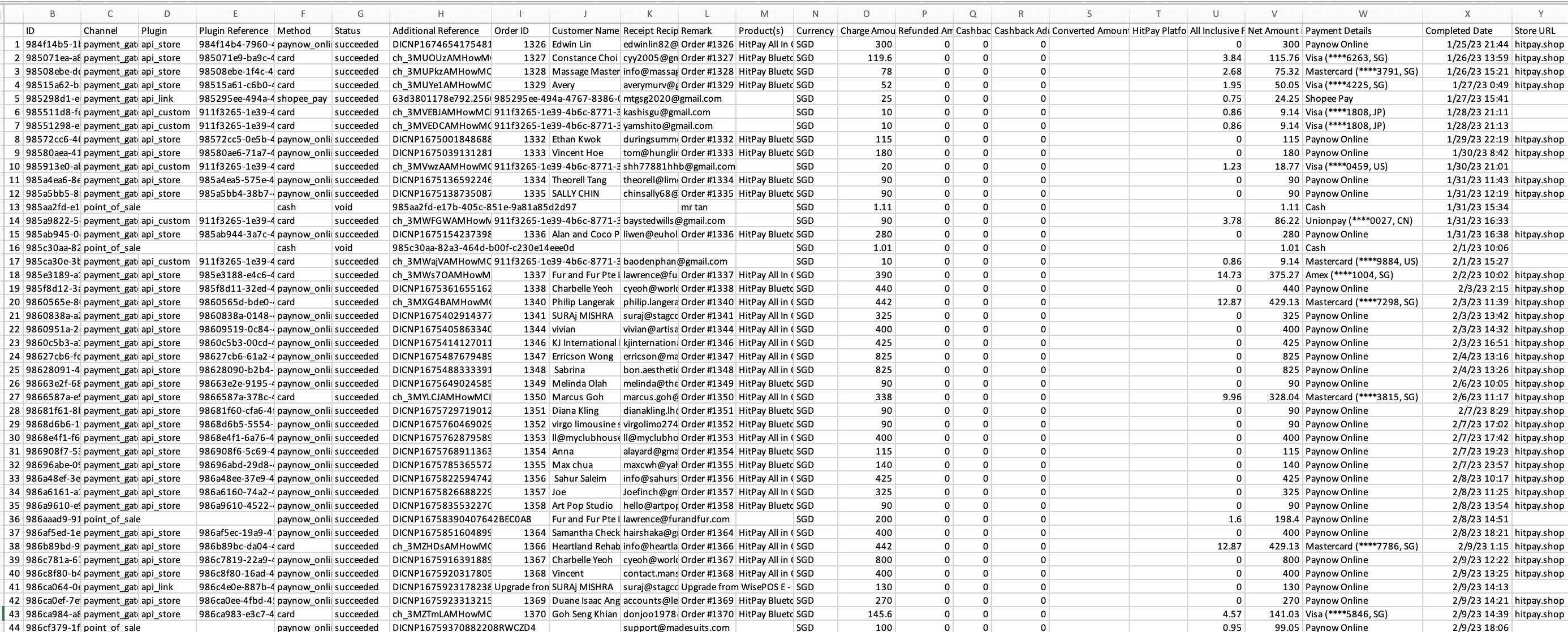

Sample Transactions Export

Sample Transactions Export

Above is a sample transaction report that can be exported from your Hitpay dashboard. Here are the different information that the report may contain:

Above is a sample transaction report that can be exported from your Hitpay dashboard. Here are the different information that the report may contain:- ID - States the Transaction ID of the payment

- Channel - States whether the payment was made via Payment Gateway or Point of Sale

- Payment Gateway - Payments made via e-commerce plugins and APIs, Payment links, Online store, and Invoicing

- Point of Sale - Payments made using the Point of Sale feature via Web or POS app

- Plugin - States what plugin was used for the payment

- Plugin Reference - States the corresponding reference ID of the plugin used

- Method - States the payment method used

- Status - States whether payment is successful, voided, or refunded

- Additional Reference - States the reference ID of the payment from the payment provider

- Order ID - States corresponding Order ID if payment was for a website checkout

- Customer Name - States the customer's name

- Receipt Recipient - States the customer's email address and where the receipt can be sent to

- Remarks Column - Any additional description for the payment

- Products - States the products ordered for the payment

- Currency - States the currency used to charge the payment

- Charge Amount - States the transaction amount based on the original currency

- Refunded Amount - States any refunded amount

- Cashback - States the cashback amount if applicable

- Cashback Fee - States the cashback fee amount if applicable

- Converted Amount - States the converted amount to home/default currency

- All Inclusive Fee Amount - States corresponding transaction fee in home/default currency

- Net Amount - States the net amount of transactions after fee is deducted

- Payment Details - States the payment method details

- All Visa and Mastercard payments from cards issued locally will be considered domestic card payments

- All American Express payments, and Visa and Mastercard payments from cards issued outside of home country will be considered international card payments

- Completed Date - States the timestamp when the payment was completed

- Store URL - This field specifies the website URL where the payment was made. If you are using the same HitPay account across multiple e-commerce stores, you can use this value to differentiate them.

Types of Reports

| Report Type | Description | Accessibility | |

|---|---|---|---|

| Transactions List | Displays a list of transactions processed within a specific time period. Accessible via the Transactions Tab. | Can be acccessed by navigating to the Transactions tab | |

| Sales Summary | Offers an overview of sales within a specific time frame, including gross sales, refunds, net sales, fees, and net collected. | Accessible by navigating to the Tools tab and clicking on Reports. | |

| Sales by Payment Methods | Summarizes the number of payments, gross sales, net collected, and associated fees based on various payment methods transacted via HitPay. | Accessible by navigating to the Tools tab and clicking on Reports. | |

| Sales by Products Summary | Provides an aggregated summary of total sales for each product. | Accessible by navigating to the Tools tab and clicking on Reports. | |

| Sales by Products Detailed | Offers a detailed breakdown of products sold and the quantity sold in each order. | You can access this information under the transaction details by selecting the transaction from the Transactions tab. |

Setting Report Filters

Before you can export your sales reports, you need to set a filter based on the “Sales Channel” and you also need to specify a Date From(Start Date) & Date To(End Date)Cashiers will only be able to view their own transactions and cannot view other user’s transactions.

FAQs

Does the reports feature display transactions made outside of the POS app?

Does the reports feature display transactions made outside of the POS app?

Yes the reports feature includes all transactions made from your HitPay account regardless of channel.

What are the charges for refunds and chargebacks?

What are the charges for refunds and chargebacks?

RefundsBelow are the charges and processing time associated with refunds:

Policies are subject to change without further notice.

Fee Breakdown

You can now view a detailed breakdown of all fees applied to a transaction directly from the charge details page. To access the fee breakdown:- Navigate to Payments > Transactions on your HitPay Dashboard.

- Select any transaction to open its charge details.

- Click the “Fees breakdown” link next to the HitPay fee amount.

- Payment method fees — The fixed fee and percentage fee charged for the payment method used (e.g. PayNow, cards, e-wallets).

- Plugin fees — Any additional fees from integrations such as Shopify or other online store software.

- Currency conversion fees — For cross-currency transactions, the FX conversion fee is listed separately.

- Total fees — The sum of all fee components for the transaction.