Overview

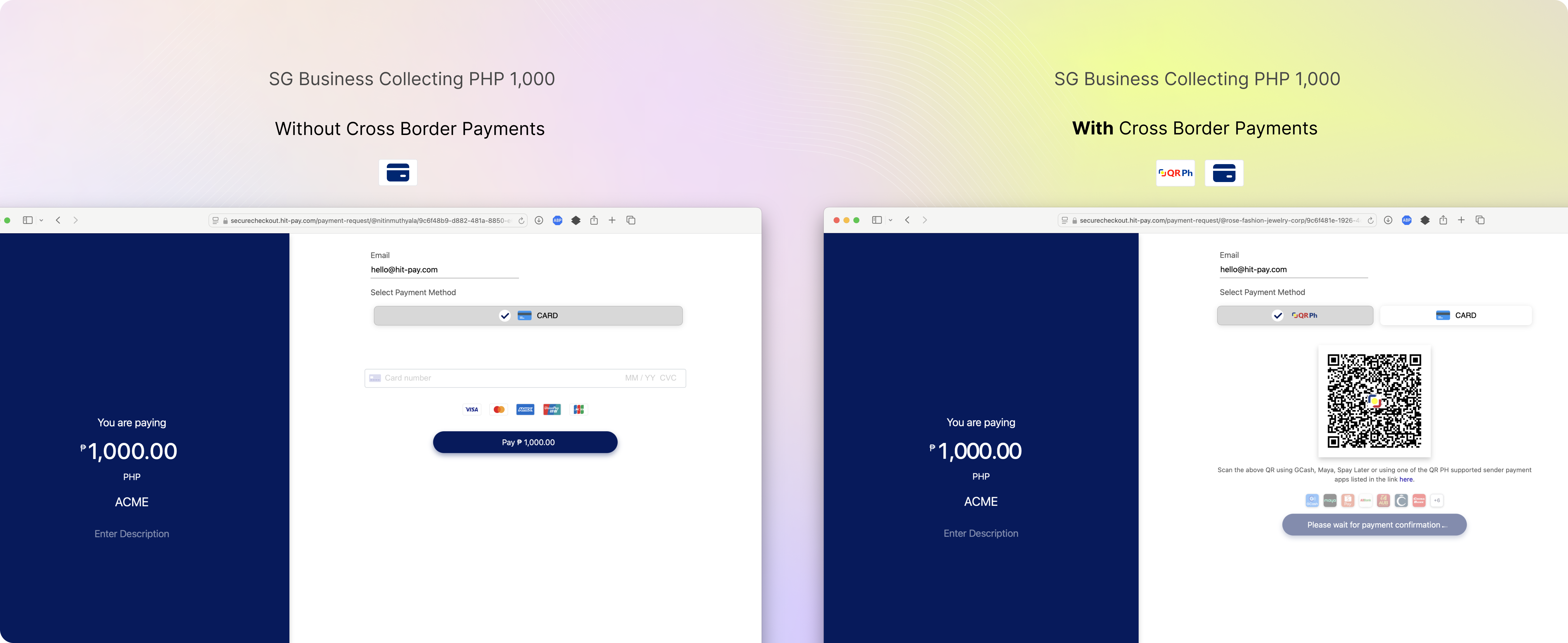

Cross-border payments refer to transactions where the payer and the recipient are in different countries. This functionality enables you to expand your market reach by accepting payments from customers in various countries using their local payment methods. For instance, your business based in Singapore can accept payments from a customer in the Philippines using the QRPH payment method. HitPay also supports virtual account collection in 13 currencies: SGD, AUD, CAD, CHF, CNH/CNY, EUR, GBP, HKD, JPY, NOK, NZD, SEK, USD.

List of Cross-Border Methods

These cross-border payment methods are available for all onboarded businesses.| Payment Method | Popular In | Customers Pay In | Merchants Receive In | Online Payments? | In-person Payments? (QR) |

|---|---|---|---|---|---|

| PayNow | Singapore | SGD | SG HitPay Wallet | ✓ | ✓ |

| QRPH | Philippines | PHP | PH HitPay Wallet | ✓ | ✓ |

| VietQR | Vietnam | VND | VN HitPay Wallet | ✓ | ✓ |

| PromptPay | Thailand | THB | TH HitPay Wallet | ✓ | ✓ |

| TrueMoney | Thailand | THB | TH HitPay Wallet | ✓ | ✓ |

| LINE Pay | Thailand | THB | TH HitPay Wallet | ✓ | ✕ |

| WeChat Pay | China | SGD / MYR | SG / MY HitPay Wallet | ✓ | ✕ |

| PayID | Australia | AUD | AU HitPay Wallet | ✓ | ✕ |

| QRIS | Indonesia | IDR | ID HitPay Wallet | ✓ | ✓ |

| UPI | India | SGD | SG HitPay Wallet | ✓ | ✓ |

| DuitNow | Malaysia | MYR | MY HitPay Wallet | Coming Soon | Coming Soon |

| Pix | Brazil | BRL | BR HitPay Wallet | Coming Soon | Coming Soon |

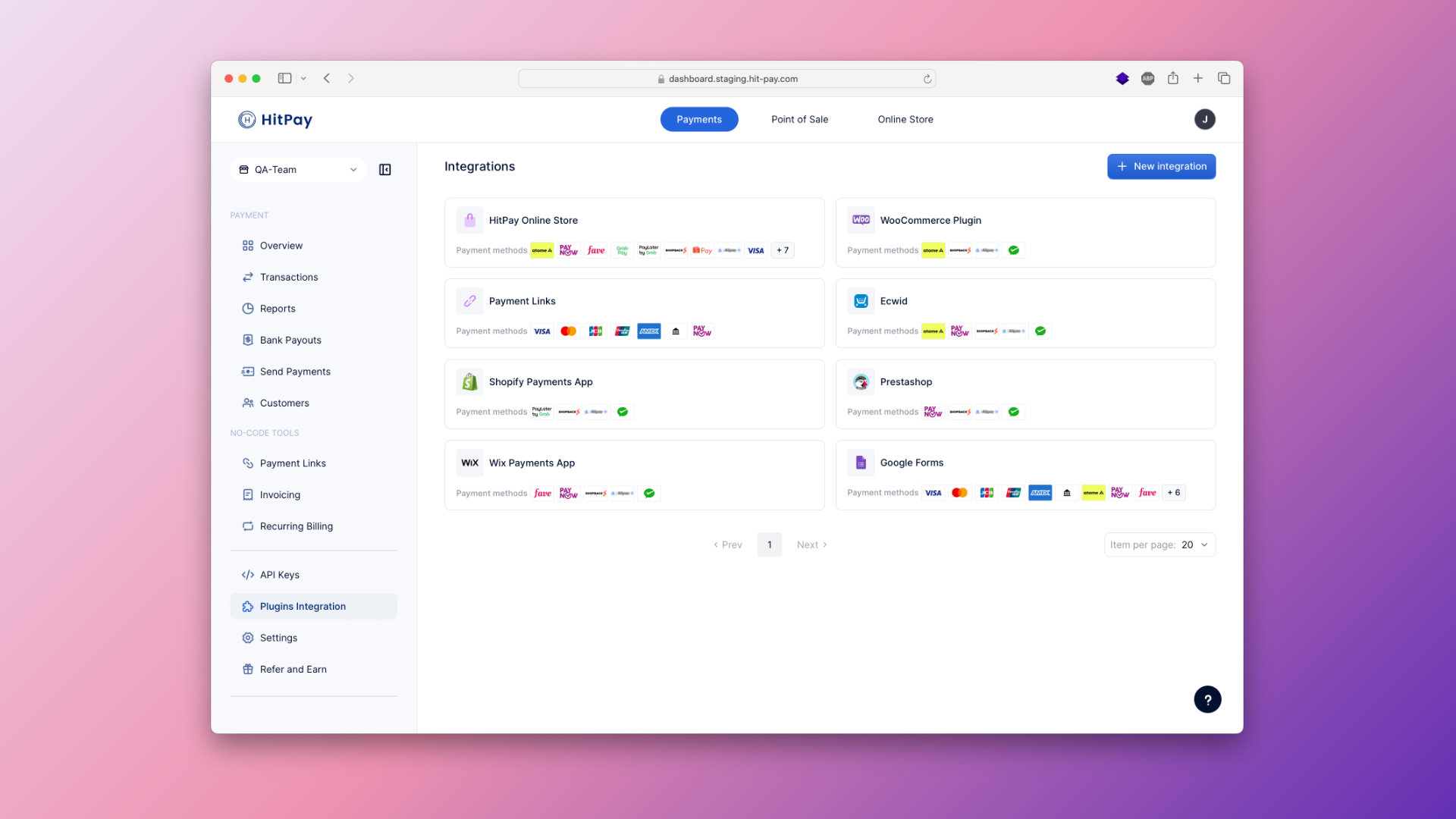

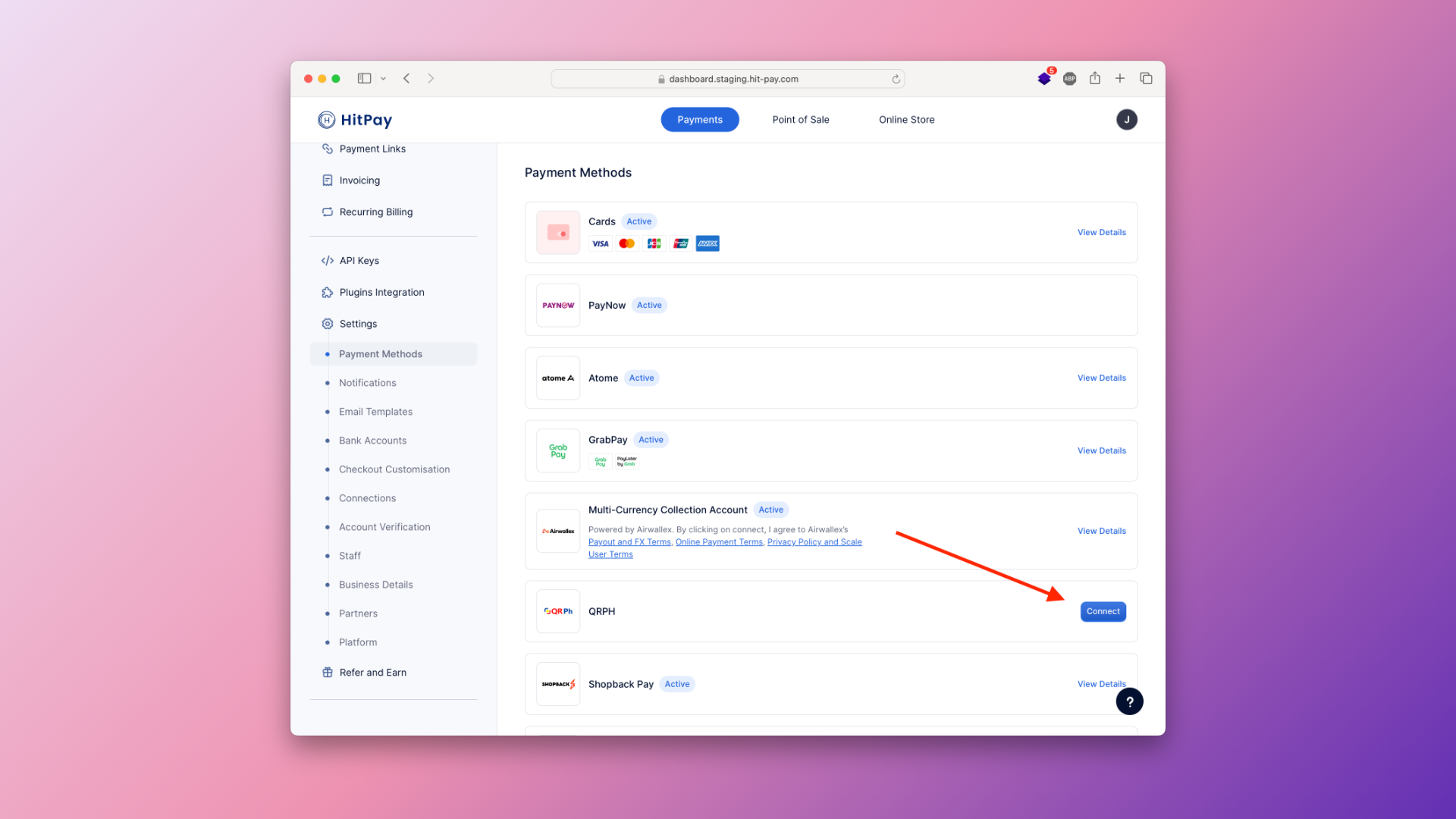

Enabling Cross-Border Payment Methods

To set up cross border payment methods on HitPay, follow these steps:Complete the Onboarding

- Navigate to Settings > Payment Methods.

- Click Connect on the desired payment method and enter the required information.

Once your request has been submitted, our partner providers will review your requests within 3-5 business days.

Accepting Cross-Border Payments

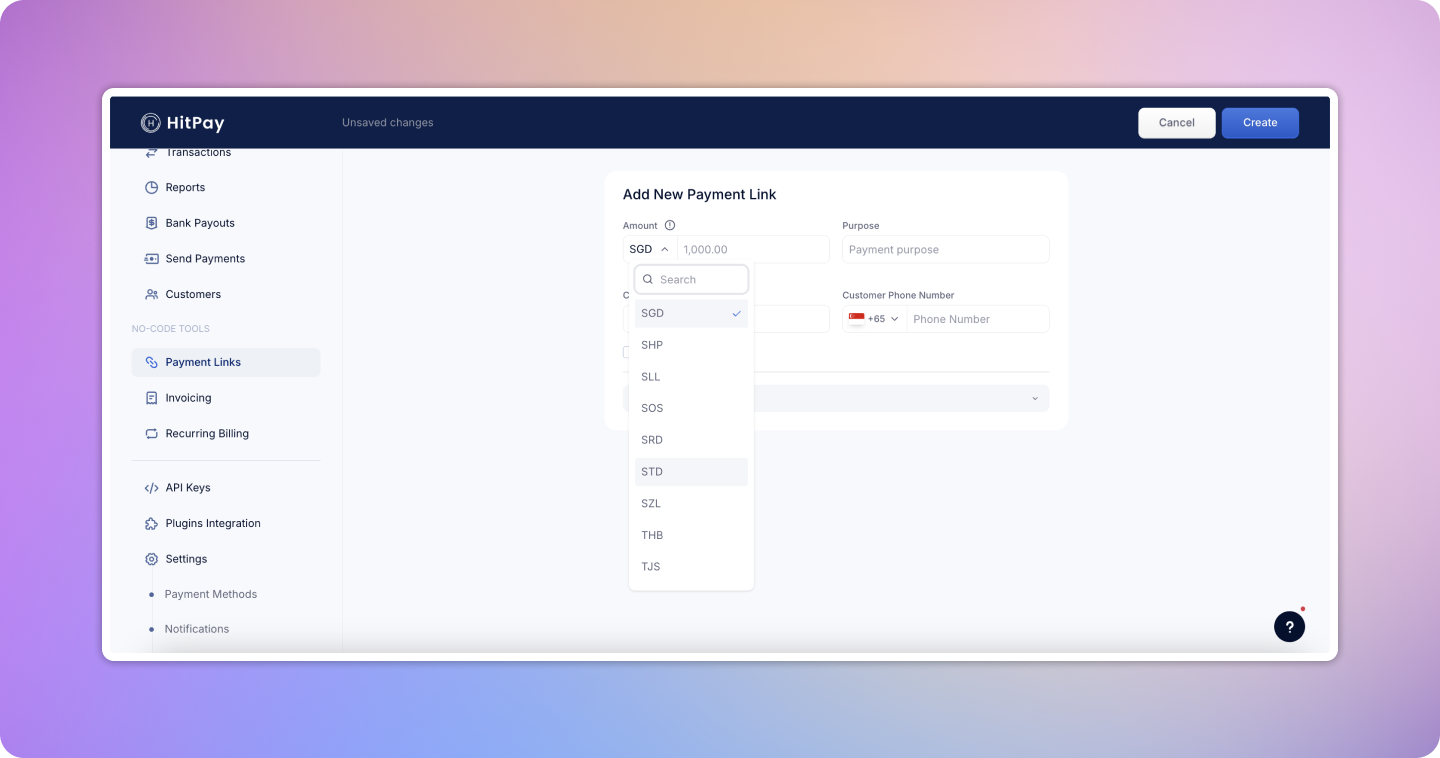

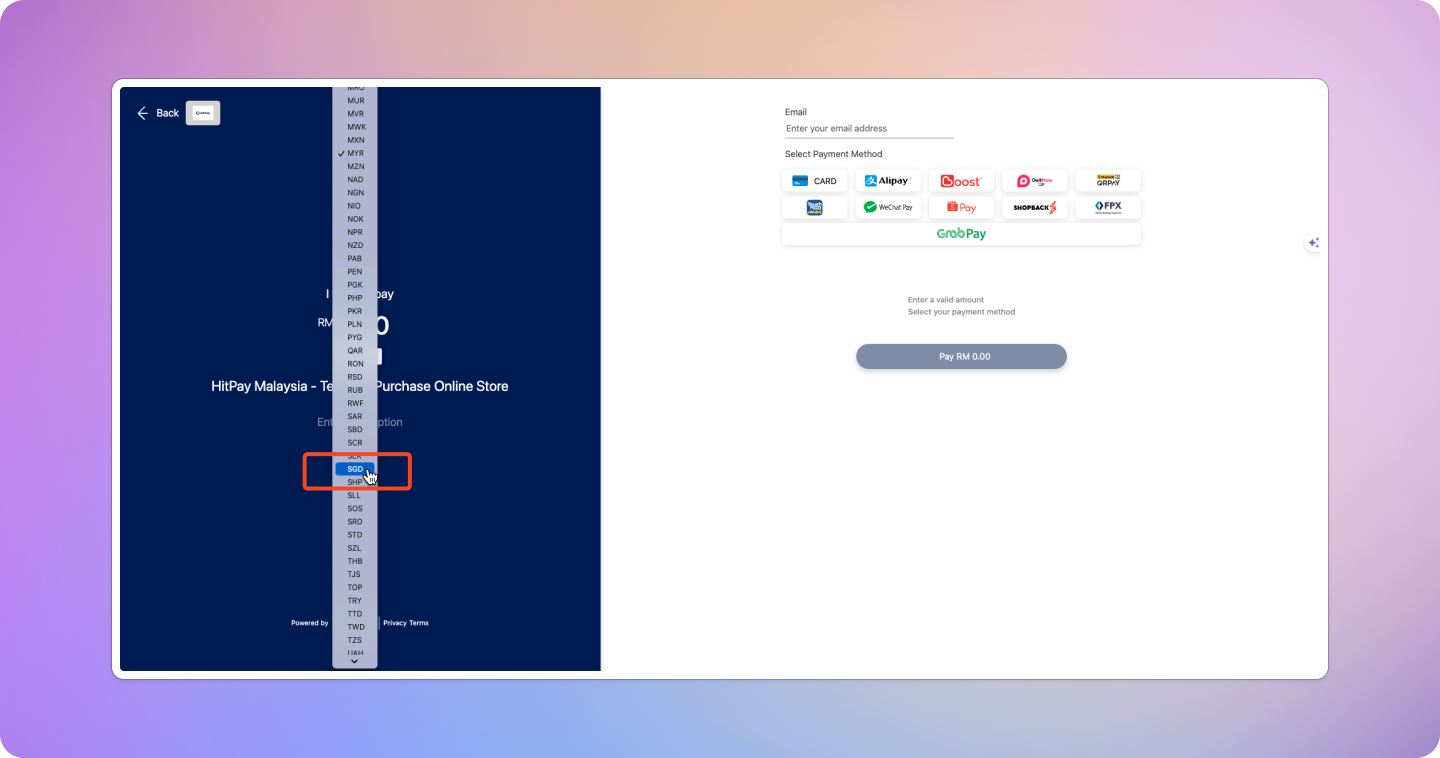

Online Payments

- Create payment link with charge currency supported by the cross border payment method (e.g. SGD for PayNow). Customers will pay in this currency.

- Customers will see cross border payment method option.

- Customer makes payment.

- You receive payments in your HitPay wallet.

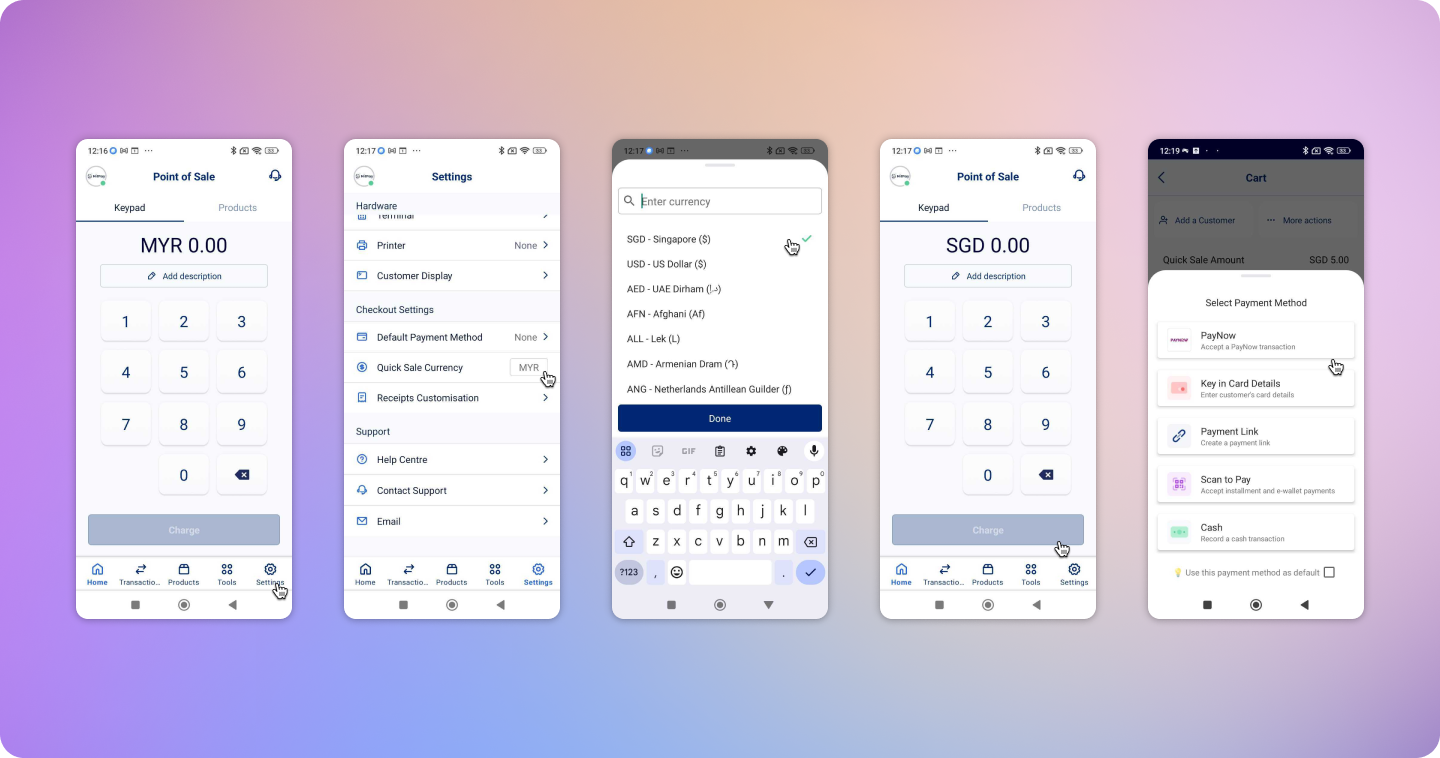

In-Person Payments

- Go to “Settings” > “Quick Sale Currency”.

- Change “Quick Sale Currency” to the charge currency supported by the payment method (e.g. SGD for PayNow). Customers will pay in this currency.

- Complete payment transaction.

- You receive payments in your HitPay wallet.

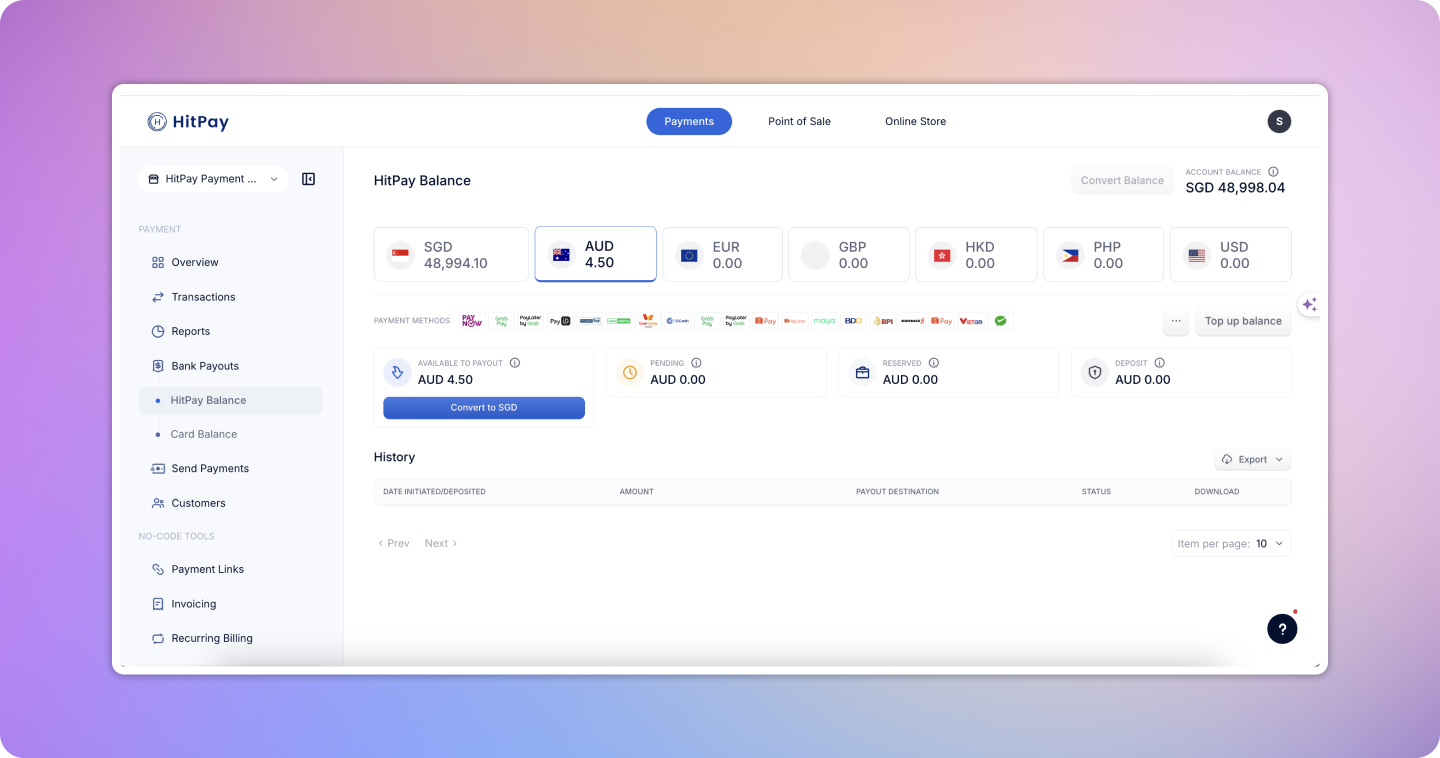

Managing Payouts and Cross-Border Wallets

When accepting a cross-border payment method, the amount is directly credited to your HitPay wallet in the same currency. For example, when accepting PHP (using QRPH), the amount is added to your PHP wallet. If your business does not have a wallet balance in that currency, it will be automatically created upon the first incoming payment. You have the option to keep the collected amount in the wallet and use it for “Send Payments,” or you can convert it to your main wallet. The converted amount will be included in your daily payouts.